The mission of our state program is to promote tax and fiscal policy that leads to higher economic growth and improved quality of life for taxpayers throughout the U.S. states.

Our state tax policy experts are routinely relied upon for presentations, testimony, and media appearances on state tax and fiscal policy, and our website is a comprehensive resource for information on tax and spending policy in each U.S. state.

We produce the annual State Business Tax Climate Index, Facts & Figures: How Does Your State Compare, and Location Matters: The State Tax Costs of Doing Business, among other resources. Explore our five reforms for an increasingly mobile economy.

In recognition of the fact that there are better and worse ways to raise revenue, our Index focuses on how state tax revenue is raised, not how much. The rankings, therefore, reflect how well states structure their tax systems.

States are unprepared for the ongoing shift to remote and flexible work arrangements, or for the industries and activities of today, to say nothing of tomorrow. In some states, moreover, existing tax provisions exacerbate the impact of high inflation and contribute to the supply chain crisis.

March 23, 2023 May 22, 2024Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

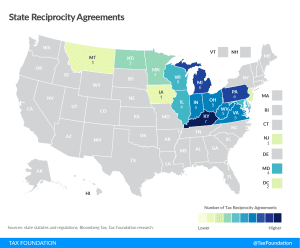

Remote and flexible work opportunities are here to stay, whether states like it or not. With enhanced opportunities to take their job with them wherever they please, more workers can factor tax burdens into their decision of where to live.

Wayfair online sales tax remote sellers compliance issues with marketplace facilitator laws" width="300" height="207" />

Wayfair online sales tax remote sellers compliance issues with marketplace facilitator laws" width="300" height="207" />

The current patchwork of state laws taxing marketplace facilitators is complex, burdensome, and inefficient. States should work to resolve these issues and standardize the otherwise disparate requirements—with or without an inducement from Congress or the courts.

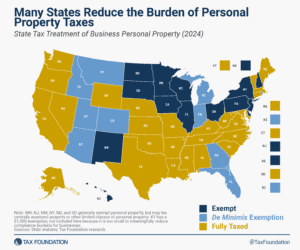

All policy choices involve trade-offs—but occasionally, the ratio of costs and benefits is shockingly lopsided. Adopting a de minimis exemption for tangible personal property (TPP) taxes is just such a policy: one which massively reduces compliance and administrative burdens at trivial cost.

The sales tax is the second-largest source of state tax revenue and an important source of local tax revenue, but decades of base erosion threaten the tax’s share of overall revenue and have prompted years of countervailing rate increases.

By 2034, the gas tax and other car-related excise taxes are projected to raise less than half of the Highway Trust Fund’s outlays. While broader tax and spending reforms are necessary for overall deficit reduction, improving transportation funding would be a crucial step forward.

Summer has arrived and states are beginning to implement policy changes that were enacted during the legislative session (or are being phased in over time).

Portland residents face some of the country’s highest taxes on just about every class of income. In an era of dramatically increased mobility for individuals and businesses alike, that’s not a recipe for success.

To stay competitive in an increasingly mobile post-pandemic world, states and localities must learn from the tax policy successes and failures of their neighbors and communities across the nation.